.jpg.aspx?width=300&height=148) 401k Table of Contents

401k Table of Contents

-

Eligibility

-

Website Registration

-

2026 IRS Contribution Limits

-

Contribution Adjustments

-

Beneficiary Designation

-

Roll-Over / Roll-In

-

401k Match

-

Pre-Tax or Roth

-

Emergency Distributions

-

SageView Advisory Resources

-

Plan Documents

National Seating & Mobility encourages you to accumulate savings for retirement through pre-tax and Roth (after-tax) payroll deductions. NSM offers a discretionary match based on meeting company performance goals. See the match section below for additional details.

Enrollment is easy and fast. You can start, stop or change your contributions at any time. Log on to Empower's website, or call and speak with a Participant Service Representative.

Eligibility

All NSM employees are eligible for participation in the 401k plan. This includes part-time employees.

Waiting Period - New hires are eligible as of the

first of the month following a 90-day wait. Rehires are eligible immediately, as long as they have met the original waiting period.

Example: New hire's first day is January 15th. First day of eligibility would be May 1st.

Auto Enrollment - New hires are auto-enrolled at 3% pre-tax. Employees are given notice of auto-enrollment in their offer letter and through the Initial Automatic Enrollment Notice. This notice is included in onboarding for acknowledgement and it is mailed from Empower to the participant's home address on file. If you do not want to be enrolled, contact Empower directly. You can change your election before your first contribution or any time thereafter.

Website Registration

Website:

www.empowermyretirement.com

Phone:

800-338-4015

NSM's Retirement Account Number:

556520

- Log on and select Register.

- Choose the I do not have a PIN tab.

- Follow the prompts to create your username and password.

2026 IRS Contribution Limits

- $24,500 for age 49 and under

- $32,500 for age 50-59 and 64+

- $35,750 for age 60-63

*New in 2025 - Secure 2.0 allows for individuals aged 60-63 a “super catch-up” of an additional $3,250 beyond the standard catch-up provision.

Contribution Adjustments

- Log on to www.empowermyretirement.com

- From the dashboard, click the plus sign to add a new contribution type. Or, adjust your contribution rate up or down by sliding the scale.

- You can also adjust your retirement age and investment style directly on the dashboard.

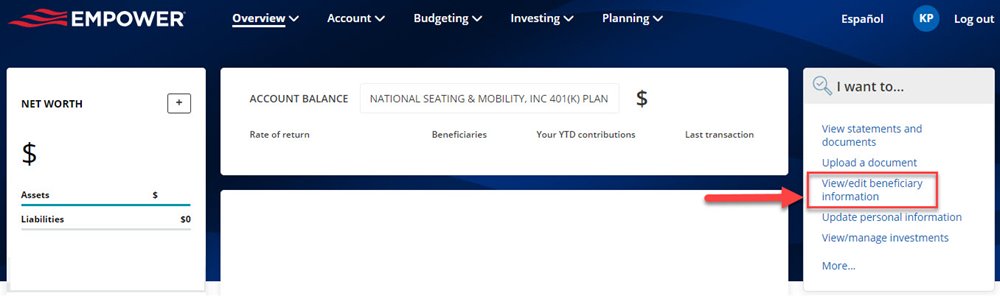

Beneficiary Designation

Participants may designate the following types of beneficiaries to receive their retirement plan assets:

- Primary - Identifies the primary recipient of the participant's assets

- Contingent - Identifies who should receive the participant's assets if the primary beneficiary dies before payment of the participant's dealth benefit.

Participants may:

- Designate any individual or entity as primary and/or contingent beneficiary.

- Request to change or revoke a beneficiary designation at any time.

- Note - When a new designation is received in good order, it supersedes the prior beneficiary designation.

Spousal Consent: Married participants are generally required to designate their spouse as a primary beneficiary under the terms of the Plan. To designate someone other than, or in addition to, their spouse as primary beneficiary, participants must obtain spousal consent in writing, waiving the spouse's right to receive all or a portion of the participant's death benefit.

401k Match

NSM encourages all employees to accumulate savings for retirement through pre-tax and Roth (after-tax) payroll deductions. As an added incentive to participate, NSM offers a discretionary match to employees.

NSM's match is included in each paycheck, so your match funds can accumulate sooner and earnings can grow faster!

The Human Resources Team has put together the following list of

frequently asked questions to help address some common concerns about the match. Please review the list and feel free to email any additional questions to:

benefits@nsm-seating.com or contact Empower at: (800) 338-4015.

Currently, the match is calculated as follows:

- NSM will match $0.35 for every $1.00 the employee contributes, up to 6% of eligible wages.

- Both pre-tax and Roth deductions count toward the match calculation; the match dollars from NSM will be contributed to participant accounts as pre-tax only.

- NSM will include all regular earnings, PTO, holiday pay, overtime, commissions, and bonus earnings when calculating the eligible wages for the plan year.

- The match will be calculated and deposited into participant accounts each pay period.

- Some plan participants may miss out on the full match throughout the year because they may front-load contributions; however, an annual true-up contribution will be made to correct this.

- Refer to the vesting schedule include in the Summary Plan Description for additional information.

Don't miss your opportunity to maximize your match!

If you don't contribute at least 6%, you are not maximizing your share in the company rewards! Of course, many employees contribute more than 6% of their salary to the 401(k). Please reference the following webpage for additional information on IRS maximum contribution guidelines: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-contributions

Vesting Schedule

Your "vested percentage" in your account attributable to matching contributions is determined under the following schedule. For NSM employer contributions, service time is rewarded on contributions. You will always, however, be 100% vested in your matching contributions if you are employed on or after your Normal Retirement Age, if you terminate employment on account of your death, or if you terminate employment as a result of becoming disabled.

Vesting Schedule for Matching Contributions

| Years of Service |

Percentage |

| Less than 1 |

0% |

| 1 |

33% |

| 2 |

67% |

| 3 |

100% |

Roll-Over/Roll-In Process

As long as your previous plan allows, you can roll-over your old 401k account and combine it with your NSM Plan with Empower.

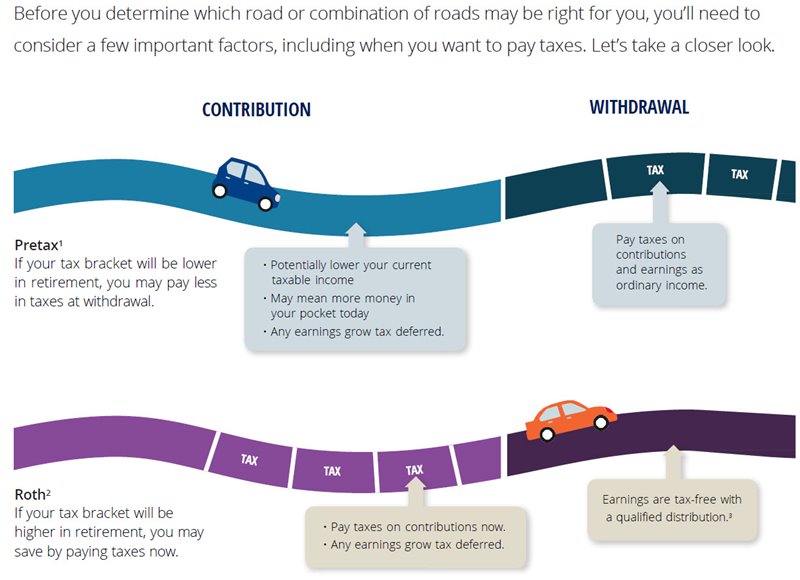

Pretax or Roth: Which road to take?

Is Roth right for me? With Roth 401k you'll make contributions with after-tax money, so you won't receive a tax break today. In exchange, any money that you withdraw in retirement will be tax-free. In a Roth 401k, you'll enjoy not only tax-free growth of your investment gains but also tax-free withdrawals in retirement. Click here to learn more.

Emergency Distributions

Federally Declared Disaster Distributions

As a participant in NSM's 401(k) Plan, you are able to save towards your retirement goals. While saving for retirement is important, we understand that sometimes circumstances out of your control can cause you to need that money sooner. We have enhanced our plan to allow for Federally Declared Disaster Distributions.

The SECURE 2.0 Act permits a participant to take a distribution of up to $22,000. To qualify, you must:

- Have experienced an economic loss because of a disaster

- Have a principal residence in a federally declared disaster area

- Take the distribution within 179 days of the disaster start date with the distribution being completed within 180 days of that date. The start date of the disaster is defined as whichever is later:

- The first date of the period specified by FEMA as the period that the disaster occurred

- the date of the disaster declaration

You will be exempt from the 10% early distribution tax penalty, and you may have the option to repay the distribution within 3 years.

To take a Federally Declared Disaster Distribution, logon to Empower at

empowermyretirement.com or call 1-833-961-5273. Click here to download the

Qualified Disaster Recovery Withdrawal Kit.

Domestic Abuse Distributions

As a participant in the NSM's 401(k) Plan, you have the ability to save towards your retirement goals. While saving for retirement is important, we understand that sometimes circumstances out of your control can cause you to need that money sooner. We have enhanced our plan to allow for Domestic Abuse Distributions.

The SECURE 2.0 Act permits a participant to self-certify that they experienced domestic abuse and to take a distribution of the lesser of $10,000 (indexed for inflation) or 50% of their account balance. You may take up to one per year and the distribution will be exempt from the 10% early distribution tax penalty.

To take a domestic abuse distribution, logon to Empower at

empowermyretirement.com or call 1-833-961-5273.

If you are experiencing domestic abuse, contact the National Domestic Violence Hotline at 888-799-7233 or text START to 88788.

Hardship Distributions

In-service hardship distributions are permitted under the NSM 401(k) plan if there is an immediate and heavy financial need. The following are the only financial needs considered immediate and heavy:

- Expenses incurred or necessary for medical care, described in Code section 213(d), for you or your spouse, children, or dependents;

- The purchase (excluding mortgage payments) of a principal residence for the Participant;

- Payment of tuition and related educational fees for the next 12 months of post-secondary education for you or your spouse, children or dependents;

- The need to prevent the eviction of you from your principal residence (or a foreclosure on the mortgage on your principal residence);

- Payments for burial or funeral expenses for your deceased parent, spouse, children or dependents;

- Expenses for the repair of damage to your principal residence that would qualify for the casualty deduction;

- Expenses incurred on account of a federally declared disaster.

For questions on a hardship distribution, or to get started, logon to Empower at

empowermyretirement.com or call 1-833-961-5273.

SageView Advisory Resources

The Participant Help Center is a complimentary, direct help line for retirement plan participants. Nolan Early is NSM's full-service wealth advisor, dedicated to working one-on-one with NSM's 401k retirement plan participants and their families who have questions on investments, asset allocation, retirement planning, and any personal finance questions. Click here or scan to schedule an appointment on Nolan's calendar!

.jpg.aspx?width=150&height=150)

Current 401k Plan Documents