2024 tax documents are now available for United States employees via UKG. Please be sure to take some time to review your W-2, W-4 and all other tax documents annually to ensure accuracy.

2024 W-2s Now Available

- 2024 W-2s are available for download in UKG.

- Visit the UKG Guides page on WNSM for step by step instructions on how to access your W-2”.

- If you indicated that you would prefer to receive a paper copy, that document will be mailed to you by January 31st. Please check your address in UKG to ensure we have the most up to date information for the mailing. All employees can download a copy of their form W-2 at any time, regardless of the preference marked in UKG.

Review Your W-4

The IRS recommends taxpayers review their W4 annually.

Has your marital situation changed? Did you have a baby? Do you have other sources of income? Did you withhold significantly too much or too little last year? Visit the

UKG Guides page on WNSM for step by step instructions on how to update your W4.

The IRS has an online calculator that can be helpful.

Click here for the IRS tool to estimate how much you should withhold in 2025. When in doubt, it’s always a good idea to consult a tax professional.

If you have any questions or need any help, please contact

payroll@nsm-seating.com or

HR@nsm-seating.com.

Benefits Tax Documents

HSABank 1099-SA

This document is used to report any distributions (withdrawals) of funds from your HSA during the respective tax year. Please note, you will not receive a 1099-SA form if you did not withdraw/spend funds from your HSA in the previous year. This document is available now. Visit www.myhsabank.com to logon to your account and download your form. From the home page, navigate to Resources > Tax Documents > Download 2024 1099-SA. If you chose to receive paper documents, your form will arrive in the mail late January/early February.

1095-Cs

As a part of the Affordable Care Act, the IRS requires the distribution of a document called a “1095” by March 3, 2025. The 1095-C is one of three versions of the Form 1095. This version is distributed by NSM to all full-time employees. The form will indicate whether or not you were offered a medical plan that met both minimum value and affordability requirements. It will also confirm each month of enrollment during the 2024 plan year.

Tax Reminders

At the start of each year, we typically receive several questions and concerns regarding payroll taxes, benefit deductions and home addresses. Unfortunately, these questions often occur as employees work on the prior year tax filing. It’s always good to catch an issue, but you ideally will catch something prior to the close of the tax year. Finding an issue as you file taxes is too late to fix the prior year’s withholding. The best practice is to look at every check stub in UKG. As you review your paystub, look carefully at both earnings and deductions. Confirm the hours and pay and confirm your tax withholding. The HR and Payroll team recommend reviewing the items below each quarter

Home Address

Is your home address current? This drives many taxes.

Benefits

Are the correct benefits being withheld from your check?

Federal Tax

Review your federal taxes withheld. Adjust your W-4 if needed.

State Tax

Review your state taxes withheld. Adjust your state return as needed.

Local Tax

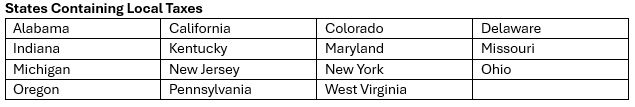

If you live in one of the states below, please review and check your local taxes. Reach out to payroll with any questions and updates.

Contact Information

Are your phone number and email address up to date?

Thank you,

Your NSM Payroll Team